Passive income can help you meet your financial goals and build wealth exponentially. Plus, it’s an effective way to save for retirement!

Passive income is defined as any asset which generates a steady and reliable stream of revenue without needing active involvement or additional effort from its owner. There are various strategies for earning passive income that may prove fruitful.

1. Investing

One of the best ways to build wealth over time is with disciplined investing, which allows your money to work for you through compound interest.

Some forms of investing, like stocks and bonds, offer dividends and interest for long-term earnings. Others allow investors to participate in private loans or real estate deals; CDs and annuities also present options.

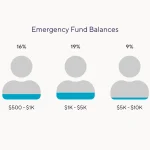

Prior to investing, it’s essential that your finances are in order. Establish an annual budget, limit spending and pay down debt as soon as possible and set aside an emergency fund as a safe haven. Once that has been accomplished, then determine how much of your income to save and invest; speaking with a financial advisor could help find suitable investments that suit your goals.

2. Real Estate

Real estate investing is widely recognized as an effective strategy to build wealth, offering steady income and the possibility for appreciation. But before diving in, some work needs to be done upfront to acquire and manage properties – and this time commitment could take its toll.

REITs provide another means of passive income generation, giving you ownership in rental properties while someone else manages daily operations for you. They may even yield higher dividends than stocks.

If you possess creative abilities, consider selling them through Etsy or Poshmark online platforms. Or if video gaming is your passion, try streaming your gameplay live to build up a fan base and monetize your efforts – these strategies may provide additional side income when times are tough or provide extra income during slower periods.

3. Stock Photography

As the old adage goes, “a picture speaks a thousand words”. People respond much more easily to visuals than text or sound, which explains why visuals play such an integral part in branding, marketing, advertising and publishing.

Stock photography can be an excellent source of income if you possess the equipment and are willing to put in the time and effort required for proper execution. Professionals recommend iStock, Shutterstock and Adobe Stock as viable platforms for those interested in starting this kind of passive income stream with their photos.

Keep in mind that true passive income requires active effort at first and it may take years before you achieve significant revenue from it. But it can be an invaluable way of diversifying income sources and building wealth over time.

4. App Development

Passive income may seem like an idealized goal that is easily attained through investments and side hustles, yet to truly generate passive income takes significant upfront work, capital accumulation and careful leveraging borrowed funds judiciously. Yet passive income provides a more secure source of revenue which can protect against economic disruptions.

Consider using your coding abilities to develop an app that can be sold and monetized, or try creating unique designs for T-shirts or other products. Or live stream your video gaming activities and build an audience who reward you with sponsorship offers and collaboration opportunities.

5. Self-Publishing

With recession forecasts abounding in the news, diversifying revenue sources is essential in mitigating risks. Passive income sources such as rental properties can help you reach wealth goals more rapidly. Here are three time-tested forms of passive income to consider for faster wealth accumulation:

Writing an eBook is one way to generate passive income by capitalizing on your expertise in one niche to drive recurring sales. But this requires significant upfront investments and ongoing marketing initiatives for maximum return.

Your passive income could come from selling items you no longer need on eBay, Amazon and Poshmark as well as other online marketplaces – though this option carries with it certain risks such as keeping inventory updated and shipping arrangements managed properly.