Let’s be honest—the straight-line career path is looking a little… dusty. Maybe you’re dreaming of a year-long sabbatical to write a novel, or you’re building a portfolio career mixing freelance gigs with passion projects. Perhaps you’re embracing the digital nomad life or taking an “encore” career turn at 50.

These non-traditional routes are incredibly fulfilling. But they can tie your stomach in knots when you think about traditional financial advice. That old playbook—save for retirement in your 401(k), buy a house, climb the ladder—often assumes a steady, predictable paycheck. So what do you do when your income looks more like a heartbeat monitor?

Rethinking the “Safety Net” for Fluid Careers

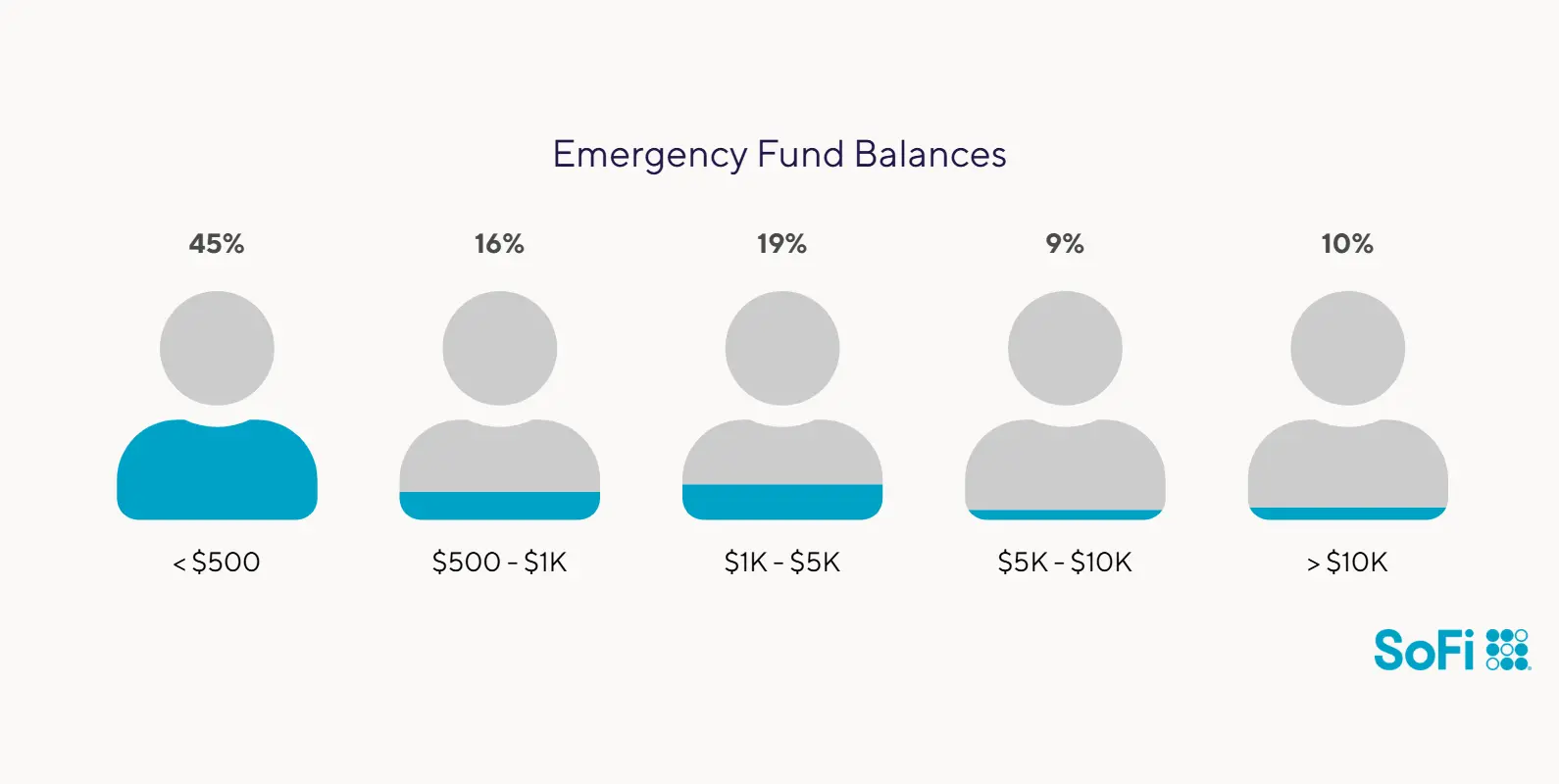

First things first. The classic emergency fund—you know, 3-6 months of expenses—is still your bedrock. But for irregular income, it’s just the start. Think of it as your “income cushion.” I’d argue you need to stretch it. Aim for 6-12 months of lean living expenses. This isn’t to scare you; it’s to empower you. This cash buffer is what lets you say “no” to a bad project or breathe easy when a client payment is late.

And here’s a key shift: your safety net isn’t just cash. It’s access. Access to a line of credit (secured while you have income), a Roth IRA (you can withdraw contributions penalty-free in a true pinch), or a side hustle that can generate quick revenue. It’s about liquidity and options.

The Sabbatical Blueprint: Saving for Your Pause

Planning a career sabbatical? It’s not just a vacation. It’s a strategic life investment. And funding it requires a separate, dedicated pot of money. Here’s a simple framework:

- Define the “Why” and the “How Long.” Is it for travel, caregiving, learning? Nail this down first—it dictates the budget.

- Calculate the Sabbatical Fund. Total your estimated living costs plus a buffer for the unexpected (always 15-20% more). Don’t forget to factor in continued health insurance costs—a major pain point.

- Create a Separate Savings Bucket. Automate transfers to a high-yield savings account. Visually watching this fund grow is powerful motivation.

- Plan the Re-entry. Seriously. Have a rough idea of what work looks like afterward. It alleviates so much of the “what’s next” anxiety that can ruin the sabbatical itself.

Tax Tactics for the Income Rollercoaster

This is where folks get tripped up. With variable income, taxes aren’t a once-a-year event. They’re a year-long game. If you’re self-employed or freelancing, you’re responsible for quarterly estimated taxes. Miss these, and you’ll face penalties.

Set up a simple system: every time you get paid, immediately transfer a percentage (say, 25-30%) to a separate “tax holding” account. It’s not your money—it’s the IRS’s. This prevents a nasty surprise come April. And honestly, consider working with a CPA who gets non-traditional earners. They can help you navigate deductions, SEP IRAs, and solo 401(k)s to save for retirement and lower your taxable income now.

Investing When Your Income Isn’t Linear

The classic advice is to invest a fixed percentage monthly. But what if some months you barely cover rent? The solution is… flexibility. Adopt a “surplus investing” mindset.

In high-income months, after topping up your emergency and tax funds, channel the surplus into your investment accounts. Low-income months? You simply pause. The key is to automate the transfer of that surplus immediately so you don’t mentally spend it. Use micro-investing platforms or set up automatic buys into low-cost index funds. The point is consistency over the long arc of your career, not month-to-month rigidity.

| Traditional Path Mindset | Non-Traditional Path Mindset |

| Income Stability as Goal | Income Resilience as Goal |

| Retirement at 65 | Financial “Seasons” & Mini-Retirements |

| Asset Accumulation | Liquidity & Access Focus |

| Set-It-And-Forget-It Investing | Dynamic, Surplus-Based Investing |

Protecting Your Future Self (The Unsexy Stuff)

Okay, let’s talk insurance and retirement. It’s easy to ignore when you’re living for now. But this is the cornerstone of true freedom.

- Health Insurance: If you’re not on a spouse’s plan, explore the ACA marketplace, professional associations, or health-sharing plans (do your research here). This is your single biggest financial risk.

- Disability Insurance: For non-traditional earners, your ability to work is your greatest asset. Own-occupation disability insurance can be a lifesaver if you’re unable to perform your specific job.

- Retirement: You have options! A Roth IRA is fantastic for its flexibility. Solo 401(k)s or SEP IRAs allow for massive contributions in your boom years. The trick is to fund these in lumps when you can, not monthly.

Embracing the Mindset Shift

Ultimately, financial planning for a non-linear life is less about complex spreadsheets and more about a fundamental mindset shift. You’re trading the illusion of security for the reality of autonomy. Your budget becomes a fluid tool for intention, not restriction. Your net worth isn’t just a number—it’s a measure of your runway to explore, create, and pivot.

It requires more engagement with your money, sure. But that engagement is what buys your freedom. You start to see money not as an end goal, but as the fuel for the life you’re actively designing—a life that probably doesn’t fit neatly into a 30-year mortgage and a gold watch.

So, forget the perfect, symmetrical plan. Build a resilient, adaptable one instead. One that has room for dry spells and windfalls, for sabbaticals and career pivots. Because a well-managed financial life shouldn’t chain you to a desk; it should be the very thing that lets you leave it.